LEGAL/LEGISLATIVE UPDATE – MAY 16, 2019

PARTIAL BAN

A federal district judge has temporarily blocked enforcement of two components of a Boston ordinance regulating short-term rentals in the city. The ordinance, approved by the City Council last year, would have required on-line platforms to ensure that listed properties comply with registration rules and to report detailed information about their listings. Airbnb challenged the ordinance, contending that it illegally required listing companies to disclose proprietary business information and imposed unreasonable monitoring requirements on them. U.S. District Judge Leo Sorokin agreed that the company “would be irreparably harmed by having to comply with an unconstitutional requirement that it disclose private business information.” Judge Sorokin also agreed that the city could not prohibit the company from doing business in the city if it posted and failed to remove illegal listings from its site. But the judge also ruled that the city could impose a $300-per-day fine if listing services accept an ineligible unit.Both sides said the decision represented a victory for them. “We appreciate the Court’s decision and its recognition of the protections afforded by established federal law as to platform immunity and privacy,” Airbnb said in a press statement.City Councilor Michelle Wu, who proposed the ordinance, said the ruling was “a big win,” not just for Boston residents, but for “all municipalities looking to protect their residential housing stock.” The decision, she added, “sets an important precedent, as other cities around the country look to pass short-term rental regulations and face the threat of litigation from Airbnb.”Airbnb prevailed in a similar suit against New York City, successfully challenging an ordinance that, a federal court agreed, would have required the company to disclose a “breathtaking” amount of proprietary information. But the Ninth Circuit Court of Appeals upheld a Santa Monica regulation requiring on-line rental companies to ensure that owners using their platforms are duly licensed by the city. Airbnb and Home Away had both challenged that measure.

Airbnb challenged the ordinance, contending that it illegally required listing companies to disclose proprietary business information and imposed unreasonable monitoring requirements on them. U.S. District Judge Leo Sorokin agreed that the company “would be irreparably harmed by having to comply with an unconstitutional requirement that it disclose private business information.” Judge Sorokin also agreed that the city could not prohibit the company from doing business in the city if it posted and failed to remove illegal listings from its site. But the judge also ruled that the city could impose a $300-per-day fine if listing services accept an ineligible unit.Both sides said the decision represented a victory for them. “We appreciate the Court’s decision and its recognition of the protections afforded by established federal law as to platform immunity and privacy,” Airbnb said in a press statement.City Councilor Michelle Wu, who proposed the ordinance, said the ruling was “a big win,” not just for Boston residents, but for “all municipalities looking to protect their residential housing stock.” The decision, she added, “sets an important precedent, as other cities around the country look to pass short-term rental regulations and face the threat of litigation from Airbnb.”Airbnb prevailed in a similar suit against New York City, successfully challenging an ordinance that, a federal court agreed, would have required the company to disclose a “breathtaking” amount of proprietary information. But the Ninth Circuit Court of Appeals upheld a Santa Monica regulation requiring on-line rental companies to ensure that owners using their platforms are duly licensed by the city. Airbnb and Home Away had both challenged that measure.

PATIENT FEDERAL RESERVE

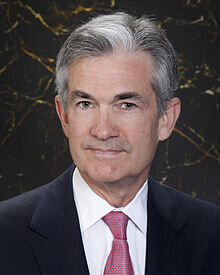

Looking at mixed economic reports – a slight increase in consumer spending and a slight decline in consumer confidence – and with no evidence of inflationary pressure, the Federal Reserve’s Federal Open Market Committee (FOMC) opted for continued patience at its May meeting, leaving interest rates unchanged and indicating that this policy is likely to continue for the foreseeable future. Ignoring repeated tweets from President Donald Trump calling for rate cuts to spur economic growth, Fed directors voted unanimously to stay their current course. “Overall the economy continues on a healthy path, and the committee believes that the current stance of policy is appropriate,” Fed Chairman Jerome Powell told reporters after the Fed’s two-day policy meeting. At least for now, he added, “we don’t see a strong case for moving [rates] in either direction.”Asked about concerns that inflationary pressures may be too subdued ─ signaling underlying economic weakness and possibly justifying the rate cuts President Trump has been demanding ─ Powell said, “If we did see inflation running persistently below [the Fed’s 2 percent goal], that is something the committee would be concerned about, something we would take into account when setting policy.”Overshooting the Fed’s inflation target would be cause for concern in the opposite direction, however, potentially pushing the Fed to become less patient and more inclined to ratchet rates upward.

“Overall the economy continues on a healthy path, and the committee believes that the current stance of policy is appropriate,” Fed Chairman Jerome Powell told reporters after the Fed’s two-day policy meeting. At least for now, he added, “we don’t see a strong case for moving [rates] in either direction.”Asked about concerns that inflationary pressures may be too subdued ─ signaling underlying economic weakness and possibly justifying the rate cuts President Trump has been demanding ─ Powell said, “If we did see inflation running persistently below [the Fed’s 2 percent goal], that is something the committee would be concerned about, something we would take into account when setting policy.”Overshooting the Fed’s inflation target would be cause for concern in the opposite direction, however, potentially pushing the Fed to become less patient and more inclined to ratchet rates upward.

BLEAK OR ‘JUST RIGHT?

March economic reports didn’t provide much clarity about the direction in which economic winds are blowing. Barron’s reported recently that the International Monetary Fund has scaled back its forecast for this year “as economic pessimism grows,” while a Housing Wire headline announced much more cheerfully that “Recession Fears Diminish as the Nation Approaches a Goldilocks Economy.”The Barron’s article cited a survey in which 35 percent of the company executives responding identified an economic slowdown as their primary concern; more than two-thirds of the chief financial officers responding to a “Globe Business Outlook” survey said they think a recession will begin before the end of next year; 84 percent think a downturn will be under way by the first quarter of 2021.

March economic reports didn’t provide much clarity about the direction in which economic winds are blowing. Barron’s reported recently that the International Monetary Fund has scaled back its forecast for this year “as economic pessimism grows,” while a Housing Wire headline announced much more cheerfully that “Recession Fears Diminish as the Nation Approaches a Goldilocks Economy.”The Barron’s article cited a survey in which 35 percent of the company executives responding identified an economic slowdown as their primary concern; more than two-thirds of the chief financial officers responding to a “Globe Business Outlook” survey said they think a recession will begin before the end of next year; 84 percent think a downturn will be under way by the first quarter of 2021. But just when it seemed reasonable to begin bracing for the coming economic storms, the Bureau of Economic Analysis reported that the economy grew at a 3.2 percent annual rate in the first quarter- a much stronger performance than expected, following a tepid 2.2 percent gain in the final quarter of last year. That report spurred the Housing Wire reference to a “Goldilocks” economy that is neither too hot nor too cold, but “just right” – strong enough to sustain employment and consumer spending at reasonable levels, but not so strong that it could bring growth stalling interest rate hikes from the Federal Reserve.As if on cue, the labor market soared in April. Employers added 263,000 jobs, blowing well past expectations and sending the unemployment rate to 3.6 percent – its lowest level in almost 50 years. Wage growth was a little slower than projected, but still 3.2 percent higher than a year ago, an indication, the New York Times said, that “ordinary workers are finally sharing in the economy’s bounty.”

But just when it seemed reasonable to begin bracing for the coming economic storms, the Bureau of Economic Analysis reported that the economy grew at a 3.2 percent annual rate in the first quarter- a much stronger performance than expected, following a tepid 2.2 percent gain in the final quarter of last year. That report spurred the Housing Wire reference to a “Goldilocks” economy that is neither too hot nor too cold, but “just right” – strong enough to sustain employment and consumer spending at reasonable levels, but not so strong that it could bring growth stalling interest rate hikes from the Federal Reserve.As if on cue, the labor market soared in April. Employers added 263,000 jobs, blowing well past expectations and sending the unemployment rate to 3.6 percent – its lowest level in almost 50 years. Wage growth was a little slower than projected, but still 3.2 percent higher than a year ago, an indication, the New York Times said, that “ordinary workers are finally sharing in the economy’s bounty.”

FAIR HOUSING ADDITION

Congress is considering legislation that would add gender identity and sexual orientation to the “protected classes,” covered by the antidiscrimination provisions of the Fair Housing Act. The bipartisan legislation, co-sponsored by Senators Tim Kaine (D-VA), Susan Collins (R-ME) and Angus King (I-ME) would make it illegal to discriminate against LGBTQ individuals in the sale, rental or financing of housing.In press statements announcing the measure, the lawmakers cite recent studies indicating that same-sex applicants are more likely to be denied a mortgage or charged more for it than heterosexual couples with similar financial profiles. They also note that 21 states and more than 200 municipalities nationwide extend fair housing protections to LGBTQ individuals. The measure they are proposing would make that protection a federal mandate rather than a state or local option.“No American should be turned away from a house because of who they love, but that’s the reality many LGBTQ Americans face when they look for a home,” Kaine noted. “This is about ensuring all Americans have equal access to housing,” he added.“Safe and affordable housing is the basic building block for all Americans seeking to achieve economic, educational, and personal success,” King added. “No one should be denied access to this vital resource because of who they are,” he said, “but unfortunately, under current law there are no protections from discrimination based on sexual orientation or gender identity. This is wrong, plain and simple.”Kaine introduced a similar measure two years ago that failed to win Congressional approval. In addition to its bipartisan sponsors, the measure has 10 co-sponsors, all of whom are Democrats.

Congress is considering legislation that would add gender identity and sexual orientation to the “protected classes,” covered by the antidiscrimination provisions of the Fair Housing Act. The bipartisan legislation, co-sponsored by Senators Tim Kaine (D-VA), Susan Collins (R-ME) and Angus King (I-ME) would make it illegal to discriminate against LGBTQ individuals in the sale, rental or financing of housing.In press statements announcing the measure, the lawmakers cite recent studies indicating that same-sex applicants are more likely to be denied a mortgage or charged more for it than heterosexual couples with similar financial profiles. They also note that 21 states and more than 200 municipalities nationwide extend fair housing protections to LGBTQ individuals. The measure they are proposing would make that protection a federal mandate rather than a state or local option.“No American should be turned away from a house because of who they love, but that’s the reality many LGBTQ Americans face when they look for a home,” Kaine noted. “This is about ensuring all Americans have equal access to housing,” he added.“Safe and affordable housing is the basic building block for all Americans seeking to achieve economic, educational, and personal success,” King added. “No one should be denied access to this vital resource because of who they are,” he said, “but unfortunately, under current law there are no protections from discrimination based on sexual orientation or gender identity. This is wrong, plain and simple.”Kaine introduced a similar measure two years ago that failed to win Congressional approval. In addition to its bipartisan sponsors, the measure has 10 co-sponsors, all of whom are Democrats.

CREDIT CARD CONCERNS

Analysts who have touted falling delinquency rates as evidence of economic strength are now warning that rising credit card charge-off rates may be cause for concern. That rate ─ reflecting debts companies have decided they won’t be able to collect, increased to 3.82 percent in the first quarter ─ the highest level in seven years ─ reflecting what industry executives described as a worrying “degradation” in the credit quality of some borrowers. After falling to their lowest level in decades last year, charge-offs began to reverse course in the fourth quarter, presaging the larger first quarter increase. Although the bad debt rate remains near its historic low and the economy remains strong, industry executives are concerned in part because some borrowers who experienced financial difficulties during the financial downturn may be experiencing new problems now, but their earlier negative experiences may have timed out and are not reflected on current credit reports. “Part of the context for our caution has been not only because of how deep we are in the [recovery] cycle, but also because this is the time period when there is less information than there once was,’ Richard Fairbank, chief executive officer at Capital One Financial, told American Banker.Card issuers are still competing intensely for prime customers ─ evidenced by their aggressive television and print media campaigns. But industry executives say they are also tightening underwriting requirements, closing inactive accounts, and becoming more cautious about increasing credit lines for both existing and new customers.“If you think about lending products, there are always people who want to take your money,” Roger Hochschild, CEO of Discover, told American Banker. The key, he emphasized, is to identify the ones “who have existing cards and could get any credit card they want. Those are the [customers] we want to attract.”

Although the bad debt rate remains near its historic low and the economy remains strong, industry executives are concerned in part because some borrowers who experienced financial difficulties during the financial downturn may be experiencing new problems now, but their earlier negative experiences may have timed out and are not reflected on current credit reports. “Part of the context for our caution has been not only because of how deep we are in the [recovery] cycle, but also because this is the time period when there is less information than there once was,’ Richard Fairbank, chief executive officer at Capital One Financial, told American Banker.Card issuers are still competing intensely for prime customers ─ evidenced by their aggressive television and print media campaigns. But industry executives say they are also tightening underwriting requirements, closing inactive accounts, and becoming more cautious about increasing credit lines for both existing and new customers.“If you think about lending products, there are always people who want to take your money,” Roger Hochschild, CEO of Discover, told American Banker. The key, he emphasized, is to identify the ones “who have existing cards and could get any credit card they want. Those are the [customers] we want to attract.”

IN CASE YOU MISSED THIS

As home prices continue to outpace wage gains, the nation’s teachers, first responders and service workers are struggling to afford homes in the communities in which they work . An analysis by Trulia found that the listing prices for homes nationally increased by 19.2 percent in the last three years, while wages increased by only 6.7 percent during that period.Taking to heart the adage, “if at once (or twice or thrice) you don’t succeed, try, try again,” a handful of Republican Senators are trying again to eliminate the Consumer Financial Protection Bureau ─ the third such effort in the past three years.The more dire the warnings about climate change become, the more energy the United States seems to be consuming.Providing more evidence of the strengthening labor market, job openings exceeded job-seeking workers in March. But the 8.6 percent year-over-year increase in job postings represented the slowest growth rate in more than a year, according to a Labor Department report.More than 70 percent of millennial homebuyers are drawing their down payments from savings, a recent survey found. The results contradict the assumption that parents are helping most millennial children buy their first homes.

LEGAL BRIEFS

COMMITTEE OF ONE

No man is an island – or a board committee. A North Carolina appeals court reached that conclusion in a dispute over the enforcement of a community association’s architectural restrictions. (Makar v. Mimosa Bay Homeowners Association, Inc.) The contested design restrictions set a maximum height for fences at five feet, allowed four-foot “solid” privacy fences, but required fences taller than five feet to be ‘picket-style’. The declaration specified that an Architectural Review Committee had the authority to approve the “shape, heights, materials, colors and location” of fences and to ensure that the structures did not impede views and were consistent with the community’s “natural” setting.The Declaration also gave the declarant the authority to appoint board members and board committees during the period of developer control, but specified that the Architectural Review Committee (ARC) appointed by the owner-controlled executive board must contain “at least three members.”While the declarant, Blue Marlin, L.L.C., was still in control, the plaintiffs, Richard and Teresa Makar, constructed a wooden fence on their property that exceeded the height limits and for which they did not obtain prior approval from the ARC. The board sent them a violation notice, instructing them to submit their design to the ARC for review, which they did. Gerard Frieze, the manager of Blue Marlin, was chairman of the association’s board and was also chair and the sole member of the ARC. In that capacity, he rejected the Makars’ fence as inconsistent with the association’s design guidelines, directing them to either reduce the height of the fence or remove it.

The contested design restrictions set a maximum height for fences at five feet, allowed four-foot “solid” privacy fences, but required fences taller than five feet to be ‘picket-style’. The declaration specified that an Architectural Review Committee had the authority to approve the “shape, heights, materials, colors and location” of fences and to ensure that the structures did not impede views and were consistent with the community’s “natural” setting.The Declaration also gave the declarant the authority to appoint board members and board committees during the period of developer control, but specified that the Architectural Review Committee (ARC) appointed by the owner-controlled executive board must contain “at least three members.”While the declarant, Blue Marlin, L.L.C., was still in control, the plaintiffs, Richard and Teresa Makar, constructed a wooden fence on their property that exceeded the height limits and for which they did not obtain prior approval from the ARC. The board sent them a violation notice, instructing them to submit their design to the ARC for review, which they did. Gerard Frieze, the manager of Blue Marlin, was chairman of the association’s board and was also chair and the sole member of the ARC. In that capacity, he rejected the Makars’ fence as inconsistent with the association’s design guidelines, directing them to either reduce the height of the fence or remove it. When the Makars did not comply, the board sent them a second violation notice informing them that the board would fine them for the violation, and inviting them to attend a hearing to appeal the ARC’s decision. The board upheld the decision and gave the Makars three weeks to comply, after which they would be fined incrementally, starting at $50/day and increasing to $100/day as long as the violation continued.When further negotiations failed to resolve the dispute, the board filed a lien against the Makars’ unit to collect the more than $11,000 in accumulated fines. The Makars counter-sued, seeking a declaratory judgment holding that the ARC was not the properly constituted three-member board the Declaration required and that, as a result, its rejection of the fence design was invalid. The trial court granted summary judgment in the association’s favor, but the Appeals Court reversed.

When the Makars did not comply, the board sent them a second violation notice informing them that the board would fine them for the violation, and inviting them to attend a hearing to appeal the ARC’s decision. The board upheld the decision and gave the Makars three weeks to comply, after which they would be fined incrementally, starting at $50/day and increasing to $100/day as long as the violation continued.When further negotiations failed to resolve the dispute, the board filed a lien against the Makars’ unit to collect the more than $11,000 in accumulated fines. The Makars counter-sued, seeking a declaratory judgment holding that the ARC was not the properly constituted three-member board the Declaration required and that, as a result, its rejection of the fence design was invalid. The trial court granted summary judgment in the association’s favor, but the Appeals Court reversed.

Ambiguous Wording

The court’s analysis centered on the interpretation of the somewhat ambiguously worded declaration, which specified that the ARC appointed by the executive board under owner control should contain “at least three members,” but did not specify the composition of the committee the developer appointed, before the transition to owner control. The relevant language stated: “The Declarant shall appoint all members of the Architectural Review Committee by appointing any persons it deems fit (Owners or non-Owners).”The association argued that because the declaration did not specify the composition of the developer-appointed ARC, the one-person committee was duly constituted, empowered to reject the Makars’ fence and authorized to fine them for violating the association’s design guidelines. The Appeals Court agreed that the wording was ambiguous, but ambiguous language, the court said, must be interpreted against its drafter; and ambiguity in covenants restricting the use of land, the court added, should be resolved in favor of the interpretation “that limits [the restriction] rather than extends [it.]” Although the declaration did not clearly require the developer to appoint more than one member to the ARC, the court said, the language implied that intent. “In every instance in which this provision of the Declaration refers to prospective ARC members that may be appointed by the Declarant it uses the plural form of each noun — “members,” “persons,” “Owners,” and “non-Owners,” the court noted. The “ordinary meaning” of committee also “connotes a decision-making body comprised of more than one individual,” the court reasoned, noting that “sound judicial construction of restrictive covenants demands that . . . each part of the covenant must be given effect according to the natural meaning of the words[.]”Because the ambiguity in the document must be construed “against the party who prepared [it],” the court said, “we construe the Declaration as requiring that the ARC be comprised of more than one person” during the period of developer control. Based on that determination, the court concluded, “we are unable to agree with the HOA that the Makars’ application was denied by a properly constituted ARC.”There was no question that Frieze acted as a committee of one in reviewing and rejecting the Makars’ fence application, the court said. “Indeed, as far as the Makars’ application was concerned, Frieze was the ARC and the ARC was Frieze. Such an arrangement in which Frieze served as the sole decisionmaker for the ARC is not permitted under the Declaration.”Under the terms of the declaration, if the ARC doesn’t approve or reject an application within 45 days of receiving it, the application is deemed to be accepted by default, the court noted. Because the ARC in this case did not issue “a valid decision, we hold that the fence was deemed permissible….and the fines imposed against the Makars were not authorized.”

Although the declaration did not clearly require the developer to appoint more than one member to the ARC, the court said, the language implied that intent. “In every instance in which this provision of the Declaration refers to prospective ARC members that may be appointed by the Declarant it uses the plural form of each noun — “members,” “persons,” “Owners,” and “non-Owners,” the court noted. The “ordinary meaning” of committee also “connotes a decision-making body comprised of more than one individual,” the court reasoned, noting that “sound judicial construction of restrictive covenants demands that . . . each part of the covenant must be given effect according to the natural meaning of the words[.]”Because the ambiguity in the document must be construed “against the party who prepared [it],” the court said, “we construe the Declaration as requiring that the ARC be comprised of more than one person” during the period of developer control. Based on that determination, the court concluded, “we are unable to agree with the HOA that the Makars’ application was denied by a properly constituted ARC.”There was no question that Frieze acted as a committee of one in reviewing and rejecting the Makars’ fence application, the court said. “Indeed, as far as the Makars’ application was concerned, Frieze was the ARC and the ARC was Frieze. Such an arrangement in which Frieze served as the sole decisionmaker for the ARC is not permitted under the Declaration.”Under the terms of the declaration, if the ARC doesn’t approve or reject an application within 45 days of receiving it, the application is deemed to be accepted by default, the court noted. Because the ARC in this case did not issue “a valid decision, we hold that the fence was deemed permissible….and the fines imposed against the Makars were not authorized.”

WORTH QUOTING

"If you want to worry about something in the next two to three years, this is it." ─ Anton Pil, head of alternative investments for J.P. Morgan, describing the “explosive” growth of private credit markets.