LEGAL/LEGISLATIVE UPDATE – JANUARY 15, 2019

SHUTDOWN PAINS

Some industry executives say the prolonged government shutdown isn’t hurting the housing market – yet. But it’s not helping either. Three-quarters of the approximately 2,200 real estate brokers responding to a National Association of Realtors survey said the shutdown has had no significant impact on current housing transactions. Only 11 percent said their clients have experienced closing delays related to the shutdown, while another 11 percent said the shutdown has affected the purchase decisions of prospective clients.But there are below-the-surface impacts, the NAR acknowledged. The housing market was already struggling with the combined effects of rising interest rates, an inventory shortage and increasing affordability pressures; the government shutdown “has made matters worse,” the association noted in a press statement, by “adding another layer of unnecessary complication to the home buying process.”

Some industry executives say the prolonged government shutdown isn’t hurting the housing market – yet. But it’s not helping either. Three-quarters of the approximately 2,200 real estate brokers responding to a National Association of Realtors survey said the shutdown has had no significant impact on current housing transactions. Only 11 percent said their clients have experienced closing delays related to the shutdown, while another 11 percent said the shutdown has affected the purchase decisions of prospective clients.But there are below-the-surface impacts, the NAR acknowledged. The housing market was already struggling with the combined effects of rising interest rates, an inventory shortage and increasing affordability pressures; the government shutdown “has made matters worse,” the association noted in a press statement, by “adding another layer of unnecessary complication to the home buying process.” Another analysis by Zillow found evidence of more immediate and more tangible harm. The more than 800,000 federal employees who are not being paid during the shutdown owe a combined total of $249 million in mortgage payments and $189 million in rent payments for January which many will be unable to pay.“Like Americans in the private sector, many federal employees rely on each and every paycheck to cover critical expenses, including housing,” Zillow Senior Economist Aaron Terrazas notes in the Zillow analysis. “In many parts of the country, housing affordability is already stretched and a single missed payment can begin the long process toward foreclosure or eviction—which has long term impacts on an individual's finances and long-term economic prospects. It also could have a significant impact on the overall housing market if it continues to drag on and furloughed workers who also are would-be buyers get cold feet in the absence of paychecks,” Terrazas warns.

Another analysis by Zillow found evidence of more immediate and more tangible harm. The more than 800,000 federal employees who are not being paid during the shutdown owe a combined total of $249 million in mortgage payments and $189 million in rent payments for January which many will be unable to pay.“Like Americans in the private sector, many federal employees rely on each and every paycheck to cover critical expenses, including housing,” Zillow Senior Economist Aaron Terrazas notes in the Zillow analysis. “In many parts of the country, housing affordability is already stretched and a single missed payment can begin the long process toward foreclosure or eviction—which has long term impacts on an individual's finances and long-term economic prospects. It also could have a significant impact on the overall housing market if it continues to drag on and furloughed workers who also are would-be buyers get cold feet in the absence of paychecks,” Terrazas warns.

GOOD NEWS

An increasingly jittery public, anxious for some good news, got a solid dose of it in the December employment report: Employers added 312,000 workers to their payrolls for the month, blowing well past the 182,000 jobs analysts were predicting, and extending the streak of consecutive monthly job gains to 98 months ─ the longest on record. Employment totals for October and November were both revised upward by a combined total of 58,000, boosting payroll growth for the year to 2.6 million ─ the most since 2015. Wages increased by 3.2 percent, equaling the October gain, which was the best since April 2009.The unemployment rate inched up to 3.9 percent from 3.7 percent, but that was also a good sign, resulting from an expanding workforce that increased the labor force participation rate to 63.1 percent.“The jump in payrolls in December would seem to make a mockery of market fears of an impending recession,” Paul Ashworth, chief economist at Capital Economics in Toronto, told Reuters. “This employment report suggests the U.S. economy still has considerable forward momentum,” he added.

Employment totals for October and November were both revised upward by a combined total of 58,000, boosting payroll growth for the year to 2.6 million ─ the most since 2015. Wages increased by 3.2 percent, equaling the October gain, which was the best since April 2009.The unemployment rate inched up to 3.9 percent from 3.7 percent, but that was also a good sign, resulting from an expanding workforce that increased the labor force participation rate to 63.1 percent.“The jump in payrolls in December would seem to make a mockery of market fears of an impending recession,” Paul Ashworth, chief economist at Capital Economics in Toronto, told Reuters. “This employment report suggests the U.S. economy still has considerable forward momentum,” he added.

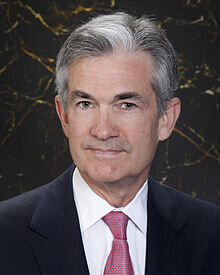

A ‘PATIENT’ FED

A ‘PATIENT’ FED

After the Federal Open Market Committee (FOMC) approved another rate hike – the fourth of the year – at its December meeting, Federal Reserve Chairman Jerome Powell said the decision reflected confidence that the economy’s strength would justify the continued rate increases the Fed was planning this year. But the recently released minutes of that meeting indicate that the position of policy makers may be softer than Powell’s immediate post-meeting comments suggested. The minutes note the doubts expressed by some committee members that the still tame inflation rate required another rate increase. While the majority agreed that “some further gradual increases” in the Fed’s benchmark rate were appropriate, they also agreed that policy makers could “afford to be patient about further policy firming.”The minutes noted “concerns over escalating trade tensions, global growth prospects, and the sustainability of corporate earnings” as the major factors arguing for “patience” going forward and making that forward path “less clear” than it has been.Fed officials, Powell included, have made it clear that they will base policy decisions on the economy’s performance, the outlook for which has turned decidedly “gloomier” since the FOMC’s December meeting. The economic downdrafts the Fed is watching include: Turbulence in the stock market (which was on a roller-coaster ride before the Federal government shutdown), a plunge in oil prices and continuing signs of weakness in the nation’s housing market. An unexpected dip in mortgage rates at year-end and a slowing in the rate at which home prices are rising may ease the affordability squeeze that has been keeping many prospective buyers on the sidelines, analysts say - -but not much. Mortgage rates are still well above their year-ago rate, and home prices are still rising faster than incomes. Instead of helping to power the economy, as it has in the past, housing may become a drag on growth, some analysts fear.“The best-case scenario” for housing is “a soft landing,” Ralph McLaughlin, deputy chief economist at CoreLogic Inc., suggests in a recent client note. The worst-case scenario is considerably worse than that.“The housing sector is stuck in neutral,” an analysis in CBS MarketWatch concludes. “The question now is whether it can regain some momentum in the new year.”

An unexpected dip in mortgage rates at year-end and a slowing in the rate at which home prices are rising may ease the affordability squeeze that has been keeping many prospective buyers on the sidelines, analysts say - -but not much. Mortgage rates are still well above their year-ago rate, and home prices are still rising faster than incomes. Instead of helping to power the economy, as it has in the past, housing may become a drag on growth, some analysts fear.“The best-case scenario” for housing is “a soft landing,” Ralph McLaughlin, deputy chief economist at CoreLogic Inc., suggests in a recent client note. The worst-case scenario is considerably worse than that.“The housing sector is stuck in neutral,” an analysis in CBS MarketWatch concludes. “The question now is whether it can regain some momentum in the new year.”

‘ROUGH’ TIMES FOR GOLF COMMUNITIES

Homes located on pristine golf courses are a forceful draw for avid golfers. But with golf participation waning, many golf centered condominium communities are encountering hard times. Recent statistics from the National Golf Foundation illustrate the problem: In 2005, when interest in golf peaked, there were more than16,000 golf courses in the U.S; by 2017, there were fewer than 15,000. Also that year, more than 200 existing golf courses closed while only 15 new ones opened. Many of the golf courses that have closed were in golfing communities, creating serious angst for golfing residents, who bought their homes because the golf course was part of the package, and non-golfers, who assumed the course would increase their property values. Golfers are losing a prized amenity and homes are losing value. The loss of an existing golf course can reduce home values by 25 percent or more, according to Blake Plumley, a development consultant, who told the Wall Street Journal he’s getting at least 7 calls a week from homeowner associations struggling with failing golf courses.Some communities try to bolster sagging golf club revenues by requiring all owners in the community to purchase memberships. But those efforts can backfire, the WSJ article noted, by reducing the pool of buyers interested in purchasing homes in the community. Barring a sudden and dramatic resurgence in golfing activity, which no one is currently predicting, these problems will get worse. Plumley estimates that only about half the troubled courses that are going to close have already been shuttered.

Many of the golf courses that have closed were in golfing communities, creating serious angst for golfing residents, who bought their homes because the golf course was part of the package, and non-golfers, who assumed the course would increase their property values. Golfers are losing a prized amenity and homes are losing value. The loss of an existing golf course can reduce home values by 25 percent or more, according to Blake Plumley, a development consultant, who told the Wall Street Journal he’s getting at least 7 calls a week from homeowner associations struggling with failing golf courses.Some communities try to bolster sagging golf club revenues by requiring all owners in the community to purchase memberships. But those efforts can backfire, the WSJ article noted, by reducing the pool of buyers interested in purchasing homes in the community. Barring a sudden and dramatic resurgence in golfing activity, which no one is currently predicting, these problems will get worse. Plumley estimates that only about half the troubled courses that are going to close have already been shuttered.

CONDO REVERSES

It’s getting harder for condominium owners to obtain reverse mortgages. Most of these loans are insured under the  (HECM) program. Because the FHA no longer approves ‘spot’ loans for individual condo units, the agency requires FHA certification for the entire community. But only about 6 percent of the nation’s condominium developments have gone through that cumbersome process, according to the Community Associations Institute.Some associations will allow owners to pursue FHA certification for the community on their own, but owners aren’t always able or willing to undertake that effort. And many communities still shun FHA certification because they fear, incorrectly, that it conveys a low-income image, or because they think reverse mortgages themselves have a negative connotation.“I turn away at least one senior a week who wants to do a reverse mortgage, who is living in beautiful condominium, but the condo association doesn’t want to go through the expense or aggravation to get them approved,” one reverse mortgage specialist told Housing Wire. (The spot approval problem aside, because of the government shutdown, FHA reverse mortgages aren’t being processed at all, even where communities have FHA certifications.Renewing the spot loan approval process would solve the problem, industry executives say, and Congress actually approved legislation that would achieve that goal more than two years ago. But the Department of Housing and Urban Development (HUD) has not yet finalized the rules that would restart the program. So at least for now, many of the condo owners seeking reverse loans are hitting a funding wall.

(HECM) program. Because the FHA no longer approves ‘spot’ loans for individual condo units, the agency requires FHA certification for the entire community. But only about 6 percent of the nation’s condominium developments have gone through that cumbersome process, according to the Community Associations Institute.Some associations will allow owners to pursue FHA certification for the community on their own, but owners aren’t always able or willing to undertake that effort. And many communities still shun FHA certification because they fear, incorrectly, that it conveys a low-income image, or because they think reverse mortgages themselves have a negative connotation.“I turn away at least one senior a week who wants to do a reverse mortgage, who is living in beautiful condominium, but the condo association doesn’t want to go through the expense or aggravation to get them approved,” one reverse mortgage specialist told Housing Wire. (The spot approval problem aside, because of the government shutdown, FHA reverse mortgages aren’t being processed at all, even where communities have FHA certifications.Renewing the spot loan approval process would solve the problem, industry executives say, and Congress actually approved legislation that would achieve that goal more than two years ago. But the Department of Housing and Urban Development (HUD) has not yet finalized the rules that would restart the program. So at least for now, many of the condo owners seeking reverse loans are hitting a funding wall.

IN CASE YOU MISSED THIS

While industry executives are growing increasingly concerned about signs of weakness in the housing market, Lending Tree’s chief economist, Tendayi Kapfidtze, thinks a housing slowdown might be beneficial, giving buyer incomes a chance to catch up with home prices, and giving historically low inventories a chance to “normalize.”Lack of housing inventory isn’t the only problem afflicting the housing market; the National Association of Home Builders report that nearly 80 percent of millennials responding to a recent survey said they could afford fewer than half the homes that are available for sale in their areas.Buyer confidence in the housing market, measured by a Fannie Mae survey, plummeted in December, falling 12 points below the November gauge and ending the year at 83.5, more than 2 points below the year-ago level and a survey low.The mood of small business executives has also darkened. The small-business optimism index crated by the National Federation of Independent Business fell to its lowest level in seven months in November, reflecting shrinking expectations for future sales and business conditions and growing concern about the “political climate.”“Smart home” technology that lets consumers control their lights and heat remotely and get shopping reminders from their refrigerators, also makes it easier for spouses and significant others to harass partners with whom they are at odds.

LEGAL BRIEF

The accidental drowning of a child is a tragedy under any circumstances, but it also triggers inevitable questions about liability. In this case (Salyer v. Brookview Village Condominium Association), the parent of a toddler who drowned in a condominium hot tub contended that the condo association was at fault. The Ohio courts disagreed. The parents of two-year-old Traetin Reyes attended a party as guests of a unit owner, who had reserved the pool area for the private event. The hot tub, located on a raised platform near the pool, was out of service on the day of the party. A sign posted next to the tub noted that fact. While Traetin’s father was changing his clothes after swimming, the child wandered alone back to the pool area, fell into the hot tub (which was not enclosed), and drowned.Traetin’s mother, Rose Salyer, sued the association, arguing that it had negligently maintained the hot tub as a “attractive nuisance” that had lured the toddler to his death. The association rejected the negligence charge, contending that swimming involves inherent risks, which Traetin assumed voluntarily. The trial court granted summary judgment for the association, which Salyer appealed.The appeal involved two competing legal theories: The “recreational activity” doctrine, holding that people who engage voluntarily in an athletic activity assume risks related to it, unless the owner’s actions are reckless or intentionally harmful. And the “attractive nuisance theory,” holding that if owners are aware that a condition poses an unreasonable risk and know that children have access to the area, they are liable for injuries suffered by children who trespass in the area. The operative word here is ‘trespass.”The attractive nuisance theory would apply, the trial court and the Appeals Court agreed, only if Traetin were a “trespasser,” which, they said, was not the case. Traetin and his parents were legally “licensees,” because they entered the property “by permission or acquiescence, for [their]own pleasure or benefit.”

The parents of two-year-old Traetin Reyes attended a party as guests of a unit owner, who had reserved the pool area for the private event. The hot tub, located on a raised platform near the pool, was out of service on the day of the party. A sign posted next to the tub noted that fact. While Traetin’s father was changing his clothes after swimming, the child wandered alone back to the pool area, fell into the hot tub (which was not enclosed), and drowned.Traetin’s mother, Rose Salyer, sued the association, arguing that it had negligently maintained the hot tub as a “attractive nuisance” that had lured the toddler to his death. The association rejected the negligence charge, contending that swimming involves inherent risks, which Traetin assumed voluntarily. The trial court granted summary judgment for the association, which Salyer appealed.The appeal involved two competing legal theories: The “recreational activity” doctrine, holding that people who engage voluntarily in an athletic activity assume risks related to it, unless the owner’s actions are reckless or intentionally harmful. And the “attractive nuisance theory,” holding that if owners are aware that a condition poses an unreasonable risk and know that children have access to the area, they are liable for injuries suffered by children who trespass in the area. The operative word here is ‘trespass.”The attractive nuisance theory would apply, the trial court and the Appeals Court agreed, only if Traetin were a “trespasser,” which, they said, was not the case. Traetin and his parents were legally “licensees,” because they entered the property “by permission or acquiescence, for [their]own pleasure or benefit.” Salyer argued that Traetin became a trespasser when he ventured into the hot tub, but the courts disagreed. The hot tub was located on the pool deck, “plainly visible” and readily accessible from it, the Appeals Court noted. Except for the water temperature (cold because of the broken heater), the court pointed out, the hot tub was in precisely the same condition it would have been in had it been operational. “Simply because the hot tub was non-functional and a sign indicated that it was closed, did not change Traetin’s status as a licensee…to that of a trespasser,” the court ruled.The hot tub’s status also did not alter the fact that, like the pool, it was “an open and obvious danger,” of which Traetin (and his parents, presumably) should have been aware and for which the association was not required to post a warning, the court said.Whether Traetin was too young to appreciate the risks was not relevant, the Appeals Court emphasized. Quoting language from another decision on this point, the court noted the difficulty of “requiring courts to delve into the minds of children” to determine their appreciation of sports-related risks. “We are unwilling to do this,” the court said, “since the determinative factor in a defendant’s liability in sports and recreational-activity cases is the conduct of the defendant himself, not the participant’s or the spectator’s ability or inability to appreciate the inherent dangers of the activity.” In this case, the court said, there was no question that the recreational activity doctrine applied, and no evidence that the association’s actions were negligent or had in any way contributed to the toddler’s death.

Salyer argued that Traetin became a trespasser when he ventured into the hot tub, but the courts disagreed. The hot tub was located on the pool deck, “plainly visible” and readily accessible from it, the Appeals Court noted. Except for the water temperature (cold because of the broken heater), the court pointed out, the hot tub was in precisely the same condition it would have been in had it been operational. “Simply because the hot tub was non-functional and a sign indicated that it was closed, did not change Traetin’s status as a licensee…to that of a trespasser,” the court ruled.The hot tub’s status also did not alter the fact that, like the pool, it was “an open and obvious danger,” of which Traetin (and his parents, presumably) should have been aware and for which the association was not required to post a warning, the court said.Whether Traetin was too young to appreciate the risks was not relevant, the Appeals Court emphasized. Quoting language from another decision on this point, the court noted the difficulty of “requiring courts to delve into the minds of children” to determine their appreciation of sports-related risks. “We are unwilling to do this,” the court said, “since the determinative factor in a defendant’s liability in sports and recreational-activity cases is the conduct of the defendant himself, not the participant’s or the spectator’s ability or inability to appreciate the inherent dangers of the activity.” In this case, the court said, there was no question that the recreational activity doctrine applied, and no evidence that the association’s actions were negligent or had in any way contributed to the toddler’s death.

WORTH QUOTING

“Housing could be heading for its worst year since the last housing crash." ─ James Stack, president and chief investment officer of Stack Financial Management.